In the realm of insurance, where trust and security are paramount, the winds of change are blowing stronger than ever. As a dedicated compliance professional responsible for ensuring the security, legitimacy, and seamless experience of policy issuance and claims processing within the insurance sector, you hold the key to steering your company toward a future where innovation and security harmonize seamlessly.

Digital verification technologies, encompassing KYC, authentication, and signature processes are the beacon that will guide you through this transformative journey, where biometrics step in as a real game-changer.

Pioneering the path to trust in the insurance industry

At the heart of every successful insurance operation lies trust.

- Trust that the information provided by policyholders is accurate,

- Trust that claims are genuine,

- Trust that client data is secure,

- And trust that your clients are who they say they are..

Increasing cyber threats and fraud threaten us daily, thus cultivating and preserving trust has never been more challenging, or more critical.

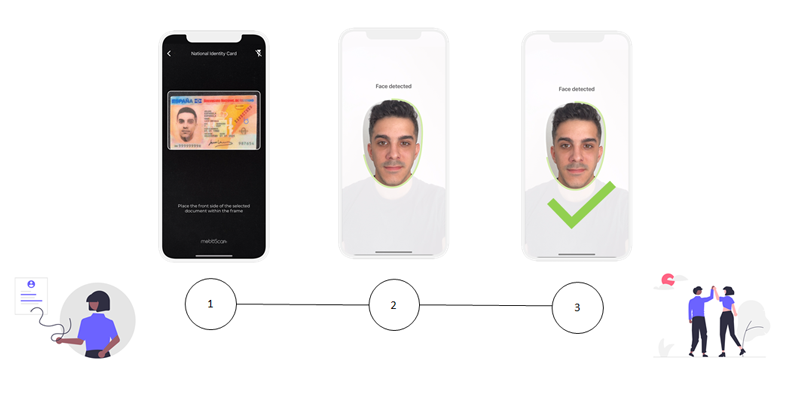

Technologies that allow to perform an automatic Digital Onboarding process offer a solution that aligns smoothly with your compliance objectives. By integrating advanced AI verification technologies and biometric signatures, insurers can build a robust and secure identity verification process. This process not only ensures that customers are who they claim to be but also prevents fraudulent activities right from the start.

Elevate Your Insurance Operations: Download Our Insurance Brochure with Biometrics Now!

Nevertheless, you also need to have trust that these technologies can genuinely enhance your processes while helping you achieve your goals. Therefore, let’s delve into some examples where our technologies can aid insurance companies wtih biometrics in their onboarding, signing, and authentication processes, whether in person or remotely:

Identity verification use cases in the insurance industry

Signing face-to-face documents in offices

The sales representatives of the insurance company can use their mobile devices to complete the entire contracting process in the offices. Their sales management app could integrate our digital signature solution, allowing them to sign agreements with a biometric signature, such as policies and accident reports.

The tablet used by the agent records the signature of the policyholder or insured party, and this signature carries full legal validity.

In-person sales outside the office

When insurance agents are conducting in-person sales outside the office, customers will have the option to purchase new products and sign these contracts digitally: They can easily scan identity documents using a tablet, and then a PDF contract can be automatically filled with the data collected from the identity document.

After reviewing the contract, the new client can seamlessly sign it with a handwritten biometric signature, which is considered an Electronic Advanced Signature in accordance with eIDAS.

Voice recognition for call centers

Insurance companies can use voice recognition to identify customers when they call their call centers to resolve any issues using their voice through voice recognition.

Santalucía was a pioneer in providing the first customer service in Spain, recognizing customers by voicethrough a predefined phrase previously registered in the system. When an agent answers a phone call, there is no need to identify the customer, saving both costs and time.

Biometric Access to customer area

Customers using online platforms are increasingly demanding swift and secure access to their online applications or customer areas. Biometric unlocking of the application addresses this issue, enabling policyholders to conduct transactions within the platform with utmost security.

With our digital onboarding and biometric authentication solutions, customer identities can be verified during the registration process or when policy conditions change, ensuring a seamless customer experience.

Identity verification in managing incidents and accidents via videocall

The management of incidents and accidents has evolved with the implementation of digital solutions, such as video expert reports. However, assistance can only be provided if the person receiving the service is correctly identified.

The process is straightforward: The affected individual is identified through biometrics at the beginning of the call or video call. This biometric identification process can be done via face or voice recognition. Afterward, the expert conducts a virtual inspection of the location where the event occurred to assess damages and evaluate the situation. This streamlined management facilitates fluid communication, ensuring an effective intervention and increasing the First Call Resolution (FCR) rate.

Contracting an insurance product through video-identification

When remotely contracting a sensitive insurance product, controls (video identification) can be conducted to ensure the security of the process. Video-identification for insurance with biometrics can be of two types:

- Attended video-identification (the process is guided by an agent)

- Unattended video-identification (an automated process without agent)

SEPBLAC advices companies to implement identification measures through video-identification.

Unlock Success: Download the FiatC Success Story Now!

Not yet convinced about the convenience of adopting these technologies? Now that you have explored the possibilities with some potential applications or use cases, here are more reasons related to security, customer experience, and regulations that encourage the adoption of these solutions and the embrace of the future of insurance compliance.

Taking security to unprecedented heights

Safeguarding your customers’ sensitive information is non-negotiable. Our biometric-based digital identification solutions empower you to fortify your defenses. By harnessing the unique biological markers of individuals – their facial features, voice and more – you’re paving the way for robust identity verification.

Imagine a world where policy issuance and claims processing occur with the utmost certainty, thanks to biometric authentication. Fraudulent activities will be detected and thwarted at the gate, ensuring a level of security that resonates with your commitment to compliance excellence.

Anti-fraud measures: a robust first line of defense

Our comprehensive anti-fraud measures provide the first line of defense against identity theft. We meticulously scrutinize identity documents, employing advanced AI technologies to detect even the most sophisticated forgeries like deepfakes.

By employing cutting-edge image recognition (OCR), data validation, document authenticity checks and liveness detection, we ensure that the individuals interacting with your insurance processes are exactly who they claim to be.

As technology evolves, so do the methods employed by fraudsters. In the face of the massive disruption caused by attacks based on artificial intelligence, you need to combat them with the same AI-based tools.

Elevating the customer experience

In the insurance sector customer expectations are rapidly shifting towards digital convenience, so adopting biometrics in your identity verification processes is not just about compliance; it’s about crafting a superior customer experience!

Think about the last time you interacted with an online service that provided a smooth, frictionless onboarding process. The convenience and efficiency were likely memorable, and the same can be achieved in the insurance industry.

By offering a fast, efficient, and user-friendly onboarding process, insurance companies not only enhance customer satisfaction but also improve retention rates. Customers want a process that respects their time and efforts, and KYC digital onboarding does exactly that. It eliminates the need for cumbersome paperwork and in-person visits, allowing policyholders to kickstart their insurance journey from the comfort of their homes.

Here are some key advantages:

- Convenience: Customers can initiate the onboarding process from the comfort of their homes, eliminating the need for physical visits or paperwork.

- Time Efficiency: Digital onboarding drastically reduces the time required for policy issuance and contracting, providing real-time results and instant approvals.

- User-Friendly Interface: Intuitive interfaces and step-by-step guidance make the process easy to understand and navigate, even for individuals who are not tech-savvy.

- Reduced Errors: Automated data entry and validation minimize the risk of manual errors, ensuring accurate information input and reducing the need for corrections later in the process.

- Personalization: Some digital onboarding solutions allow for tailored experiences, guiding users through relevant sections based on their specific needs.

- Reduced Friction: By eliminating unnecessary steps and paperwork, digital onboarding minimizes friction in the process, leading to higher completion rates and increased customer satisfaction.

- Mobile Accessibility: With mobile-friendly interfaces, policyholders can complete onboarding using their smartphones, adding an extra layer of convenience.

- Multi-Channel Access: Some solutions offer multi-channel access, allowing users to begin the onboarding process on one device and continue it on another seamlessly.

- Immediate Access: Upon completion of the digital onboarding process, policyholders can receive immediate access to their policy details, documents, and coverage information.

- Eco-Friendly: Going paperless with digital onboarding contributes to environmental sustainability by reducing paper consumption.

- Consistent Experience: Customers receive a consistent experience across various touchpoints, reinforcing the company’s brand and image.

- Higher Satisfaction: The seamless, efficient, and user-centric process of digital onboarding leads to higher levels of customer satisfaction and positive interactions with the insurance company.

Navigating the regulatory landscape

With real-time data verification, biometric recognition, and advanced security protocols, insurers can ensure that each step of the onboarding process meets the highest regulatory standards. This not only reduces the risk of penalties but also positions your company as a beacon of responsible innovation in the insurance space.

Our suite of solutions addresses a range of compliance standards, each contributing to the overall integrity of the verification process. Here’s how our solutions align with these compliance requirements:

- KYC (Know Your Customer) Compliance: KYC regulations mandate that insurance companies verify the identity of their customers to prevent fraud, money laundering, and other illicit activities. Our solutions enable thorough and reliable identity verification, ensuring that policyholders’ identities are accurately established and authenticated.

- AML (Anti-Money Laundering) Compliance: AML regulations seek to prevent the use of insurance services for money laundering or terrorist financing. Our solutions aid in detecting suspicious activities by verifying customer identities and cross-referencing them against watchlists and databases, reducing the risk of being unwittingly involved in illegal financial transactions.

- GDPR (General Data Protection Regulation) Compliance: GDPR is designed to protect the personal data of EU citizens. Our solutions prioritize data privacy and protection, ensuring that customer information is handled in line with GDPR requirements, obtaining necessary consents, and providing customers with transparency and control over their data.

- eIDAS (Electronic Identification, Authentication, and Trust Services) Compliance: eIDAS regulation establishes a framework for secure electronic transactions and e-signatures. Our solutions align with eIDAS standards, offering secure and legally recognized digital signatures and authentication methods that enhance the security and legality of digital interactions.

- SEBPLAC (Spanish Anti-Money Laundering and Terrorism Financing Law) Compliance: Compliance with SEBPLAC in Spain is crucial for combating money laundering and terrorism financing. Our solutions contribute to SEBPLAC compliance by verifying customer identities, detecting potential risks, and ensuring that your insurance operations remain aligned with Spanish regulatory standards.

By integrating these compliance standards into our identity verification solutions, we provide insurance companies with biometrics and a comprehensive approach to risk mitigation and regulatory adherence.

Streamlining policy and insurance contracting with biometrics and guided digital onboarding

Let’s admit it: time is of the essence. Every moment spent on administrative tasks is a moment lost in serving your clients and building your business. That’s where our guided digital onboarding process takes action, transforming the policy and insurance contracting landscape into an efficient, seamless journey.

- The power of guided onboarding: guided onboarding simplifies the experience for both your team and your clients, reducing the risk of errors and misunderstandings. It’s more than a mere form-filling exercise; it’s a strategic approach to ensure a smooth transition from prospect to policyholder.

- Remote processes, real-time results: the world has witnessed a shift towards contactless interactions, and the insurance industry is no exception. Our remote digital onboarding process allows clients to initiate their policy or insurance contracting journey from the comfort of their homes, removing the need for in-person visits or time-consuming paperwork.

What sets our solution apart is the ability to deliver real-time results. As clients input their information and documents, our system works seamlessly to verify and process the data on the spot. This not only accelerates the onboarding journey but also allows insurance companies to scale.

The urgency to act: you need a reliable partner

As an insurance company committed to securing your customers’ data and delivering exceptional experiences, the time to embrace KYC digital onboarding technology is now. The competitive landscape is evolving rapidly, and those who seize the opportunity to innovate will gain a significant advantage.

By partnering with Mobbeel, you’re not just adopting a technology; you’re redefining your processes for the digital age. Your decision will empower your insurance company with biometrics to build trust, enhance customer relationships, and navigate compliance challenges with confidence.

![]() The path forward is clear: Insurance companies with biometrics that prioritize trust, efficiency, and compliance are poised to thrive in the digital age. KYC digital onboarding technology represents the bridge between compliance excellence and customer-centric innovation. It’s time to embark on this transformative journey, and we’re here to guide you every step of the way.

The path forward is clear: Insurance companies with biometrics that prioritize trust, efficiency, and compliance are poised to thrive in the digital age. KYC digital onboarding technology represents the bridge between compliance excellence and customer-centric innovation. It’s time to embark on this transformative journey, and we’re here to guide you every step of the way.

Together, let’s build an insurance landscape that not only withstands the challenges of today but embraces the opportunities of tomorrow.

Contact us today to explore how our KYC digital onboarding solution can help you forge a future where trust, compliance, and customer experience converge seamlessly.

I’m a Software Engineer with a passion for Marketing, Communication, and helping companies expand internationally—areas I’m currently focused on as CMO at Mobbeel. I’m a mix of many things, some good, some not so much… perfectly imperfect.

INDUSTRY PAGE

Discover everything we can do for insurance industry

The digitalisation of the insurance sector provides policyholders with tools to automate processes, expedite policies, and manage claims with anti-fraud measures.