Digital transformation has significantly impacted the customer experience, transforming customer expectations when purchasing products or services. Biometrics has become a key technology to improve customer journeys, delivering convenience to users and letting them be identified and verified quickly and securely. But what is biometris? Biometrics is a technology that uses unique physical features of individuals to accurately verify and authenticate them.

The banking industry pioneered biometric identification in its processes when needing a tool to verify the customers’ identity remotely and, at the same time, ensure regulatory compliance. Other industries follow banks’ path, such as insurance and gaming, as they realise the biometrics advantages as an authentication method.

As implied, biometrics has evolved as a valuable tool for transforming the customer experience in many industries and seems to be the new competitive advantage for businesses. We will explore what is biometrics and how it is changing the way businesses connect with their customers.

What is biometrics?

Biometrics is a technology that uses a person’s physical or behavioural features to identify them. These characteristics can be physical features like facial recognition, voice biometrics, fingerprints, or behavioural attributes like a signature.

Each individual has unique features that can be used to accurately and reliably authenticate them. For instance, a person’s voice is exceptional and unrepeatable. Biometrics uses advanced technology to capture, analyse, and transform these unique features into data identifying an individual.

This technology has become an increasingly common mechanism in the customer experience to enhance processes’ security, customisation and efficiency. In that sense, facial biometrics is arising to diversify payment methods for financial institutions. Biometrics is also used to customise the customer experience by offering recommended products based on previous purchases. Furthermore, it can boost the efficiency of CX processes, such as in airports, to identify passengers and allow them to pass through security control without needing to show passports.

Most popular biometric systems

Once commented what is biometrics, it is neccesary to address the types of biometrics are used as digital identity verification systems. The biometric systems most in demand by companies are the following:

- Facial recognition: Facial recognition uses unique facial features to verify an individual’s identity. Facial biometric systems capture and analyse different facial points and characteristics, such as eyes shape, nose, mouth and overall face structure. These systems use algorithms to compare the captured facial features with a database to determine the identity (1:N identification) or the biometric facial template previously recorded by the same person (1:1 identification).

- Voice recognition: Voice recognition is based on the unique characteristics of a person’s voice. Voice biometric systems analyse and compare different factors such as voice frequency, tone, timbre and rhythm. This type of biometrics verifies a user’s identity by speaking or providing a voice sample.

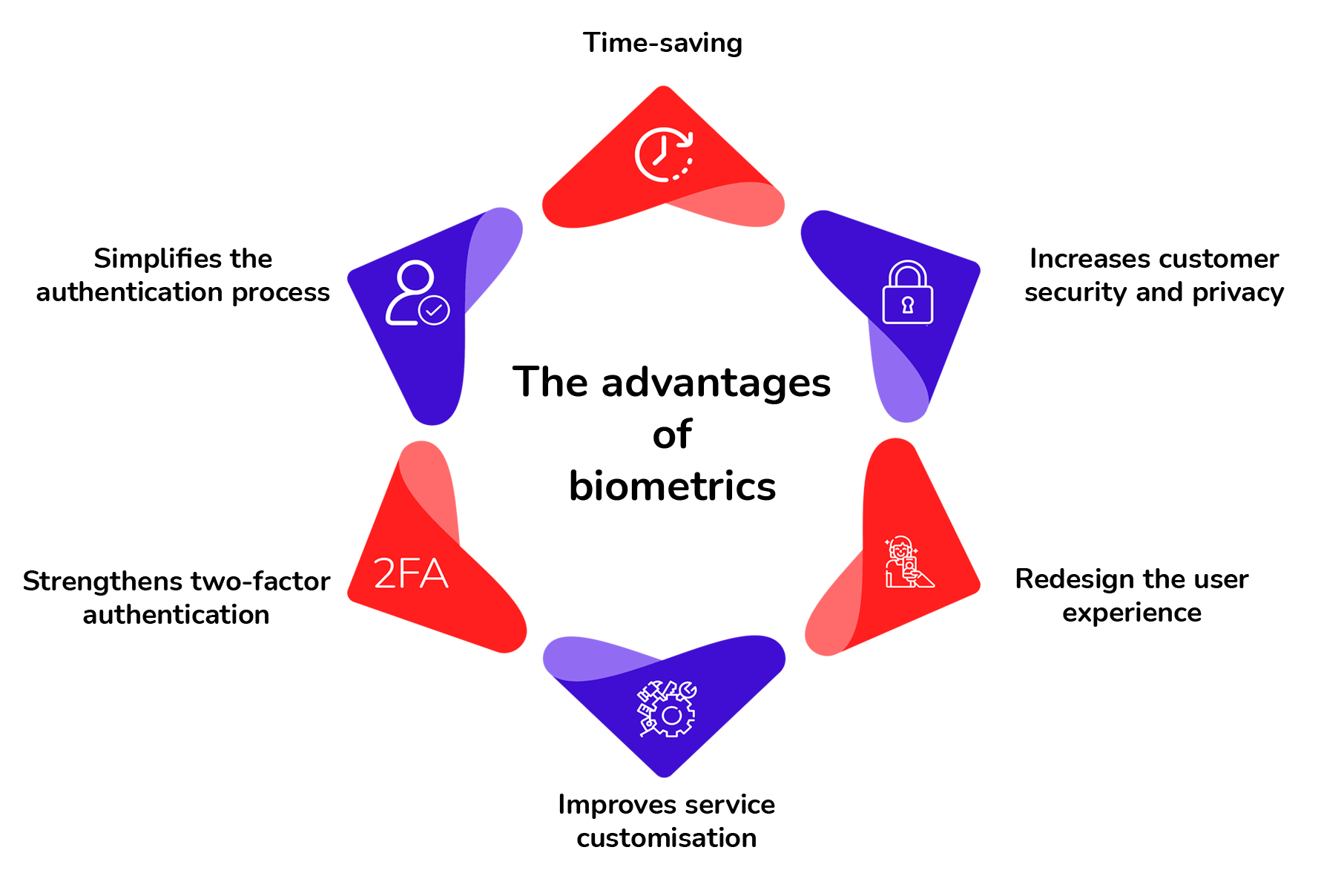

What are the advantages of biometrics for the customer experience?

The implementation of biometric systems in customer experience has meaningful advantages.

Time-saving

Biometric authentication technology is able to identify a user in a matter of seconds. Users only need to look at the camera for the technology to capture their faces or speak into a microphone for voice recognition processes. These processes shorten the time it takes to authenticate, simplifying transactions and reducing average wait time in call centres.

It increases customer security and privacy

Biometrics provides higher security and privacy than classic authentication methods, such as passwords or security questions. The inherent physical features of each individual are challenging to spoof. Furthermore, the biometric authentication process is performed without needing to share personal data, ensuring the user’s privacy.

There is no need to remember numerous passwords, minimising data breaches. It is quite important in industries that collect sensitive and confidential customer information, such as banking and insurance.

Banks use biometrics to authenticate customers in private banking and to authorise transactions to be PSD2 compliant. ATMs also adopt facial recognition technology to identify users when withdrawing cash and thus prevent unauthorised access.

It simplifies the authentication process

Passive liveness detection simplifies the authentication process by allowing users to access services and products simply by verifying their unique physical features without collaboration. It means that no active action is required from the user, and it can prove that they are genuine and not a fraud such as a deepfake.

It strengthens two-factor authentication (2FA)

Traditional authentication methods create friction and frustration for the end user. The need to memorise PIN is a learning curve many users bypass using the same password to log in to all their digital accounts.

Many companies integrate two-factor authentication (2FA) to avoid these security issues, using one-time passwords (OTP) as a second authentication factor. Nevertheless, this method based on sending a code by SMS delays the process and requires the user to leave the platform for a moment to receive this code.

Biometrics is a reliable alternative for a Strong Customer Authentication (SCA) strategy. In these cases, the process will use the user’s password as the first authentication factor and the face or voice of the person carrying out the process as the second.

Redesign the user experience

Biometrics enables companies to customise the customer experience by recognising the user and adjusting the experience according to their preferences and needs. For instance, a facial recognition system can remember a frequent customer’s preferences based on previous purchases and provide recommendations. In the case of a bank, it can use a customer’s voice to identify them and provide specific advice or offers based on their transaction history.

It improves service customisation

This technology also allows companies to customise customer service. An example is hotels that use facial biometrics to customise rooms and offer extra services based on each guest’s preferences.

What are the biometrics advantages for your industry?

Biometrics presents many advantages for different industries, including banking, online gaming, travel, logistics, retail, and insurance. Here are some use cases:

Biometrics in banking

Banks are using biometrics to enhance the security and accessibility of their services. Customers can use biometric authentication to check their bank accounts and make payments. Bank employees can also use biometrics for time tracking with biometric data.

Voice biometrics for insurance companies

Voice biometrics enables fast and accurate identity verification. By analysing features such as tone, rhythm and other vocal elements, the technology creates a unique voice template for each policyholder. When policyholders call their insurance company, such as Santalucía, their voice is compared with the previously recorded voice template, identifying the user in real-time. That way, it improves KPIs by reducing the average time per call.

Biometrics use in travel

Biometrics is also transforming the travel experience by shortening waiting times and friction. Airports are already using biometrics to verify the identity of passengers at security and border controls.

Hotels apply biometrics for guests’ check-in process and data protection. The cruise industry has also opened its doors to biometric technology for cruise ship boarding as a way to reduce check-in times, improve organisation and control the entry of tourists arriving on cruise ships.

Facial recognition in retail

Biometrics can be used for customer authentication on e-commerce, simplifying the payment process and leading to success in the shopping experience.

Biometric authentication in gaming

Gambling and gaming companies use biometrics for reliable identity verification of players to prevent underage entry and access to prize withdrawals, increasing the security of the platforms.

Biometric access control in logistics

Biometrics can improve security and efficiency in warehouse management and product deliveries. Facial recognition can control access to restricted areas.

Patient identification in hospitals

Biometrics ensures the accurate identification of patients in hospitals. Facial recognition systems verify identity in healthcare.

DISCOVER SUCCESS IN DIFFERENT SECTORS

How to enhance your platform’s UX with Mobbeel biometrics

User experience (UX) plays an important role in the success of any digital platform. A strong UX can increase brand reputation and improve customer relationships. An innovative and efficient way to improve user experience is by implementing MobbID, our leading biometric authentication solution.

MobbID uses advanced algorithms to verify the identity of users fast, accurately and securely in different environments. With MobbID, Mobbeel has combined convenience and ease of use with the highest levels of security, providing a state-of-the-art solution for your company’s authentication needs.

Our multi-biometric suite provides a seamless and fast experience allowing identification in seconds that meet high customer expectations and a culture of immediacy.

Feel free to reach out if you want to balance positive customer experience and security with a highly tested biometric identification method.

I am a curious mind with knowledge of laws, marketing, and business. A words alchemist, deeply in love with neuromarketing and copywriting, who helps Mobbeel to keep growing.