KYC technology to digital onboarding

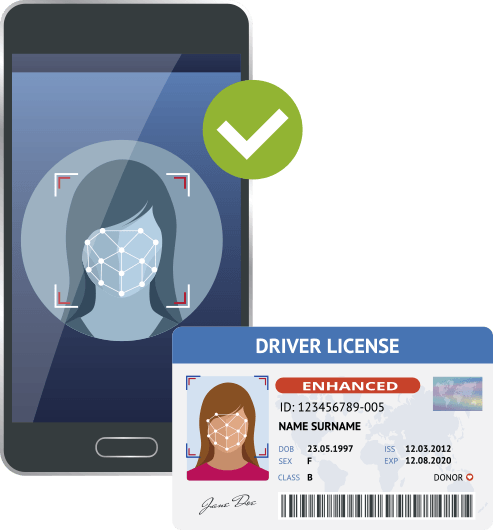

Verify the identity of your customers by scanning and validating identity documents and facial recognition in a matter of seconds.

Verify the identity of your customers should be easier

Do any of these problems sound familiar to you?

- I do not comply with the rigorousness of KYC/AML regulations.

- Many customers register under fake identities and perform fraudulent activities on my platform.

- I take hours and days to verify the identity of new registers.

- I do not offer a pleasing user experience, and my drop-out rate is high.

- My business is hardly scalable by keeping a manual identity verification process.

It should not be a complex task to comply with regulations and enable customers to take advantage of your products or services after your platform KYC onboarding digital and registration process.

KYC/AML compliance

Our KYC technology complies with the most rigorous regulations.

Identify on the spot

Allow your users to enjoy your services from the start.

Avoid fraud

Stop wasting money using your services fraudulently.

Fast Integration

Implement KYC digital onboarding in your systems just in 1 or 2 days matching with your branding.

You require a technology that ensures you verify identities with confidence

It is MobbScan, a KYC digital onboarding technology that will help you comply with KYC/AML regulations and avoid possible fraud on your platform, identifying your users with an easy and seamless process to start using your services immediately.

In addition, MobbScan is a modular and flexible solution that adapts to your more complex use cases. All these are thanks to an in-house technology developed from the ground up, resulting from more than 13 years of experience in the digital identity industry.

Pioneer project in Europe and a worldwide landmark

Aena and Vueling use Mobbeel´s technology to enrol the biometrics of their passengers in one of the pilot projects most important of its rank in the world. It enables one to go through all controls, including baggage check-in, using facial biometrics.

MobbScan: KYC digital onboarding technology designed for your peace of mind

Your clients will benefit from the user experience you provide them. You will love the easy integration, its flexibility, and its power.

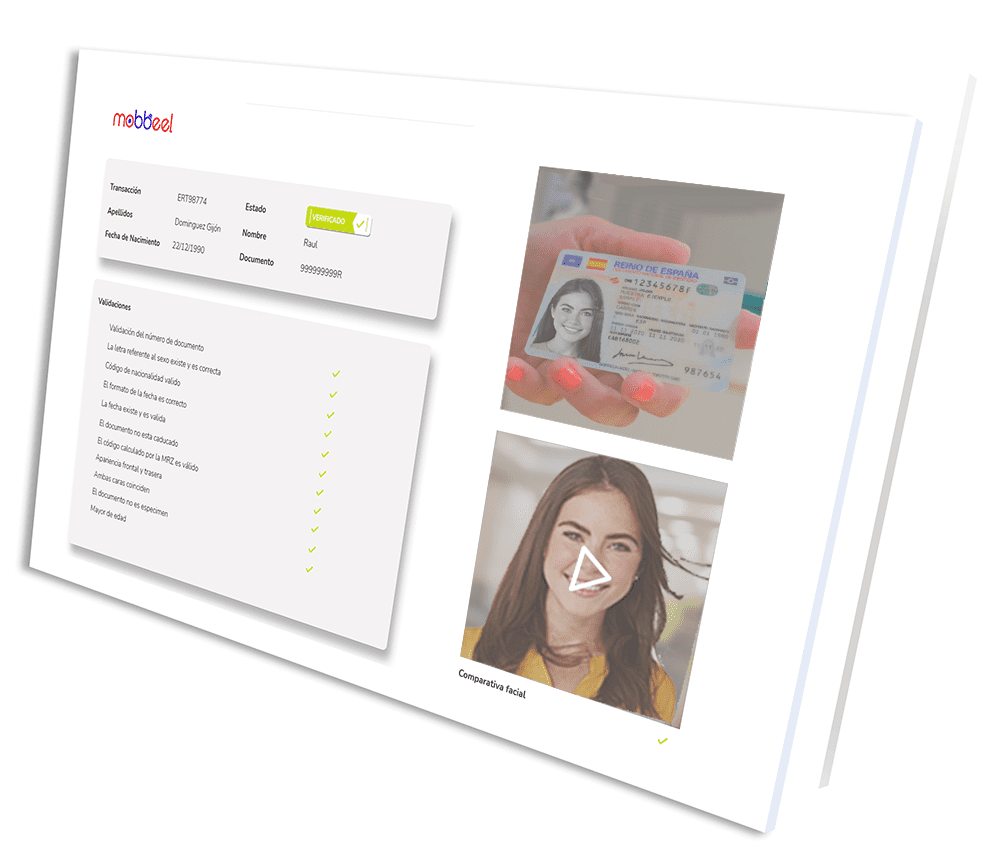

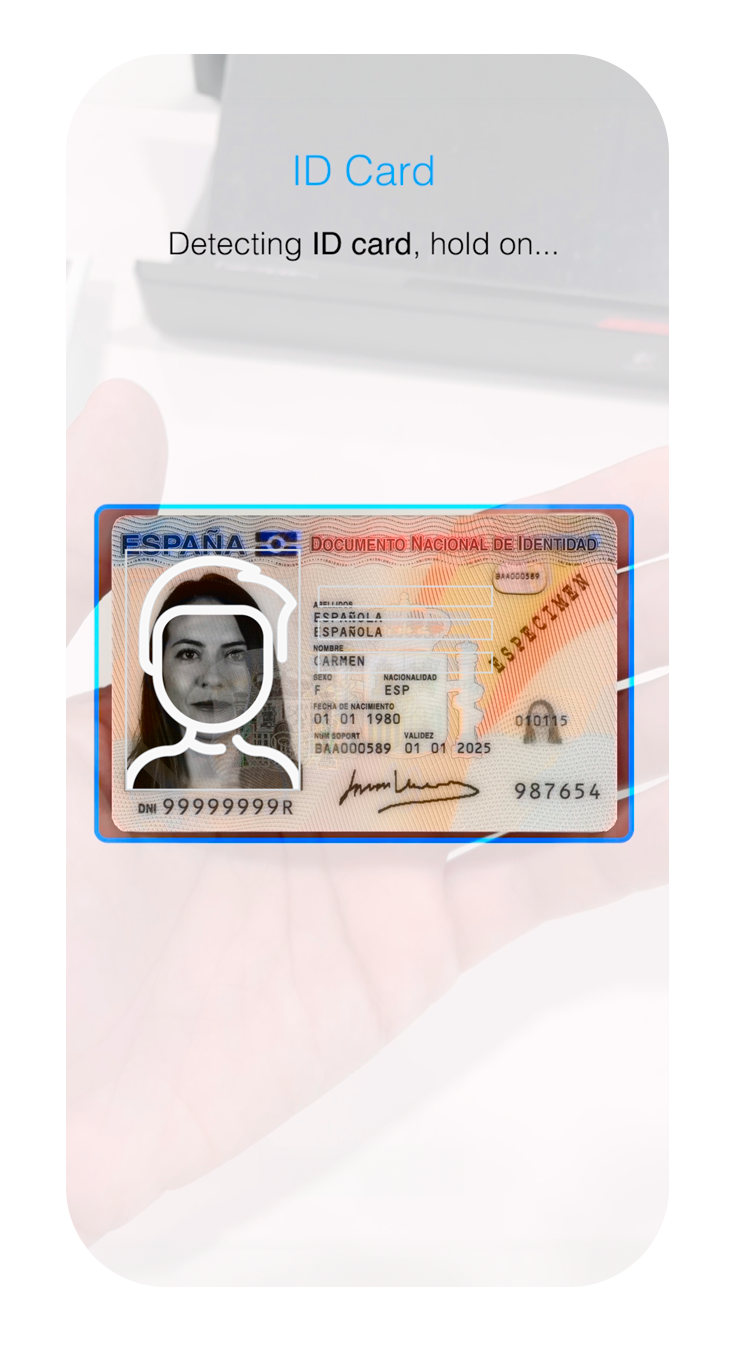

How does MobbScan work?

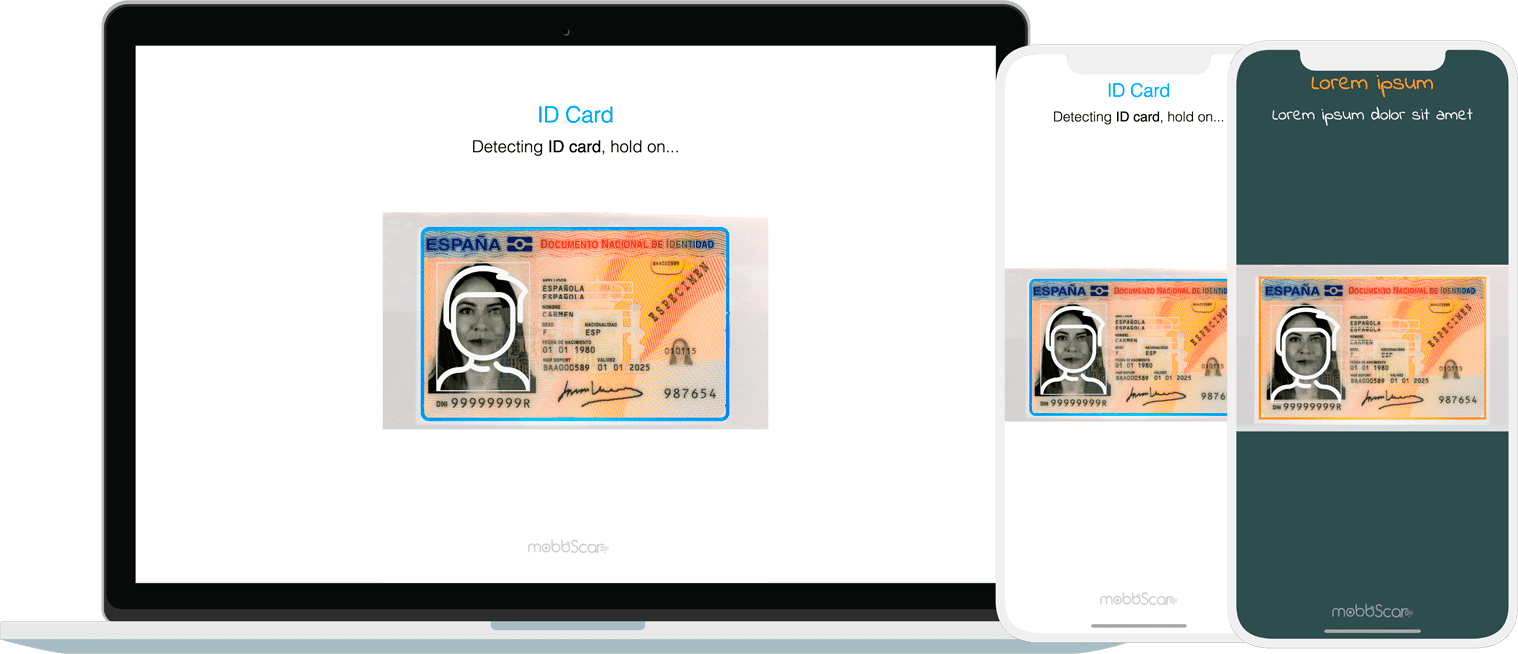

Performing an Onboarding process with MobbScan is a piece of cake! The technology captures the ID and scans it. Then it detects the user´s face verifying that they are genuine, takes a picture and returns the results with all validations.

MobbScan scans the ID card, passport, or driver´s licence automatically.

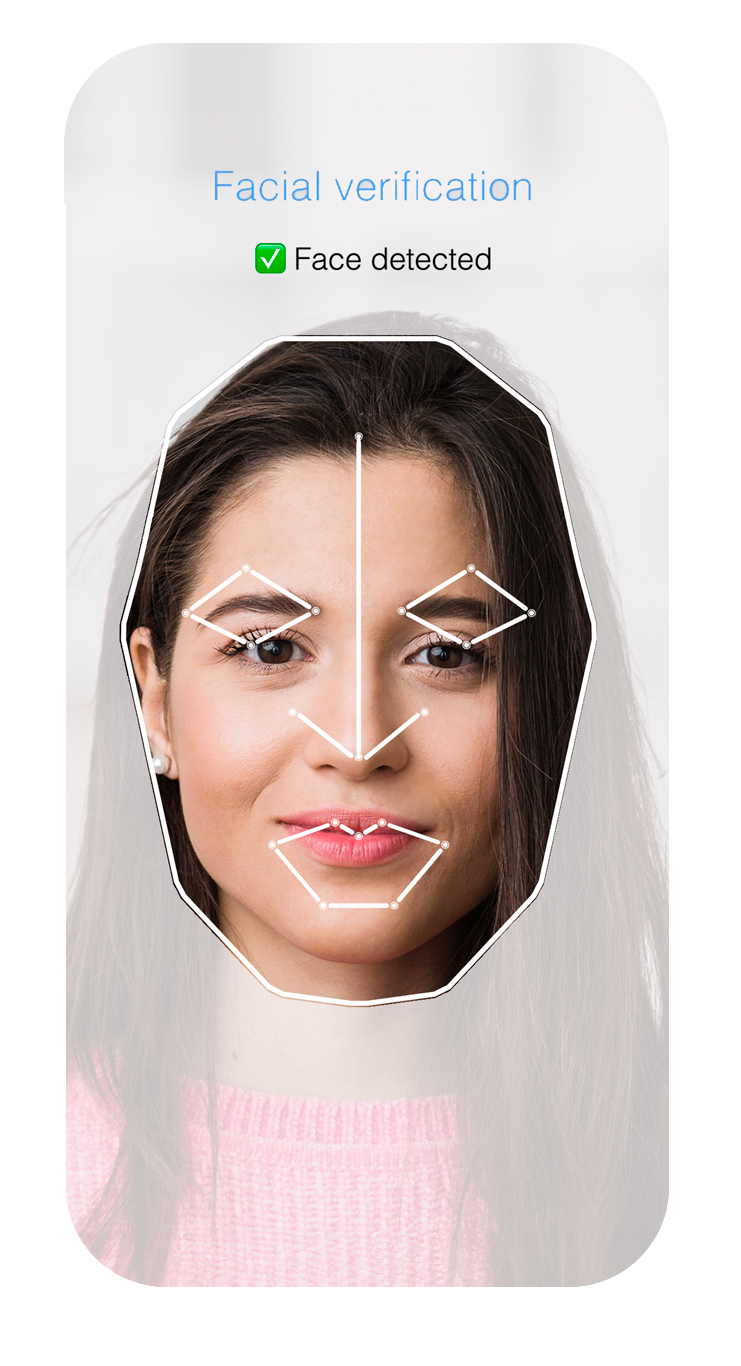

After the scanning step, it detects the face of the user and takes a selfie to check if the face matches the photo on the document and if they are the owner.

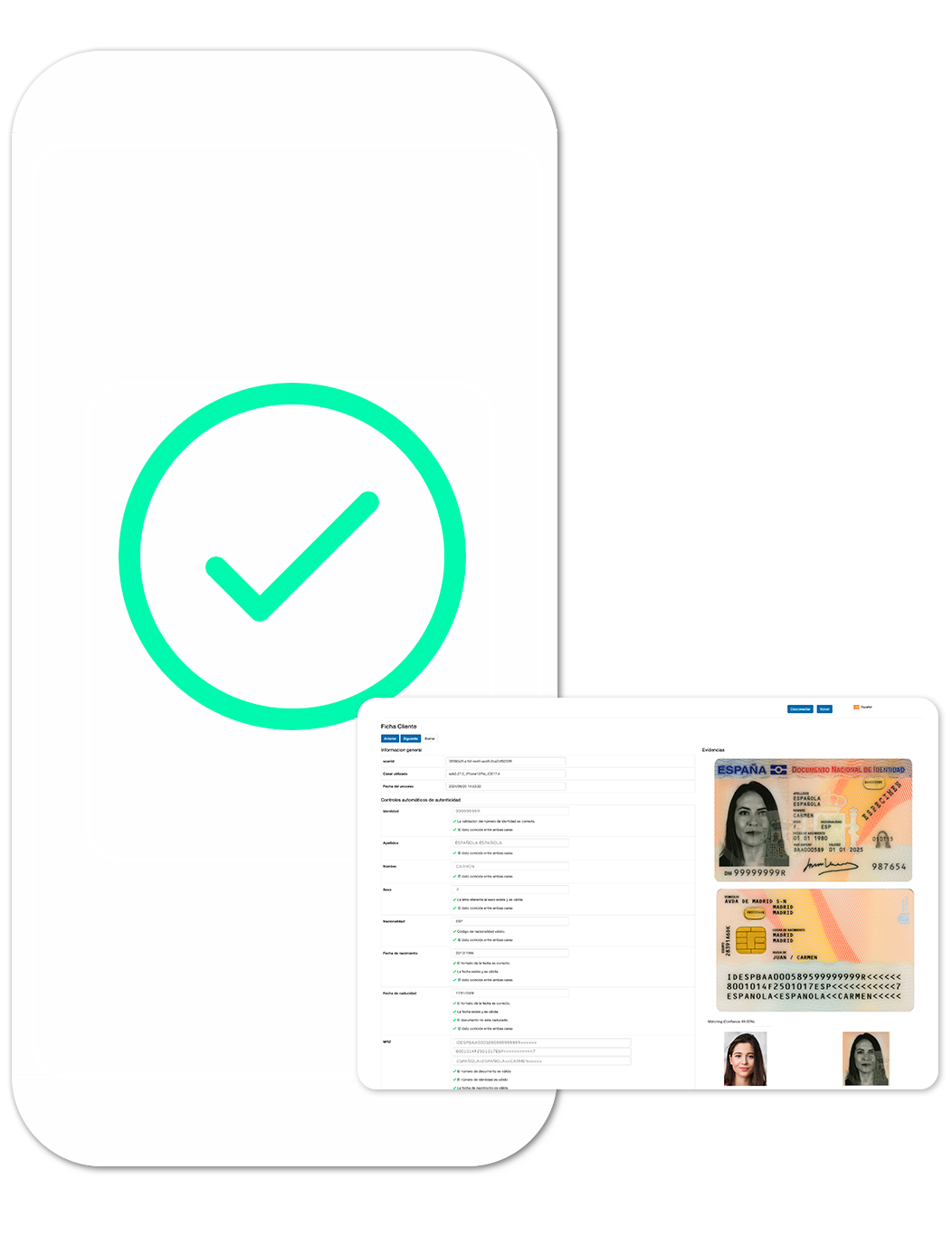

And done! It returns all data, images and validations together with the result.

More than 250 supported identity documents in 192 countries

More than 250 supported identity documents in 192 countries

Any document that identifies a user can be scanned and validated by MobbScan. MobbScan can check and validate more than 250 types of papers: IDs, passports, and driver´s licences.

In addition, the flexibility in its design enables it to support new document types easily.

ID document validation

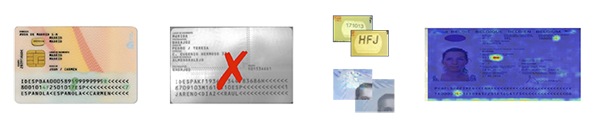

MobbScan performs multiple validations and checks on the ID document to verify its authenticity and prevent document fraud:

- It validates the data contained in the ID document itself, such as control digits, detects and analyses specimens on the document, and matches the front and back of the paper.

- It analyses the document´s appearance and detects physical manipulations, photocopies, or screenshots.

- It recognises if the document has suffered any manipulation with image editing software.

- It analyses dynamic elements such as laser marks or holograms and, if applicable, the NFC chip security.

OCR Reading

OCR Reading

Through OCR (Optical character recognition), all textual information from the image is extracted to manage it as data, fill in a form, and so forth. It makes it easier for the client to introduce personal data in a mobile environment or on a PC.

In short, MobbScan automates and accelerates the entering data process and improves user experience in the registration process.

NFC Reading

NFC Reading

MobbScan enables contact reading of the information contained in some identities documents with NFC chip:

- 3.0 Spanish ID

- ICAO MRTD (Machine Readable Travel Document) regulation complying with passports

Face recognition

Face recognition

MobbScan not only collects information from a document or validates its truthfulness but also uses biometric facial recognition to verify that the individual presenting the document is the same who appears in the document´s photo as the legitimate holder.

Liveness Detection

The identity theft attack detection techniques that Mobbeel applies can be active and passive, depending on the user´s collaboration. They can detect the following situations:

- Modification of the facial image of the ID document to match that of the user performing the management.

- Presentation of the ID document while capturing the user´s facial image during registration.

- Use of photos or masks to impersonate another person.

- Atack with still images or videos of the individual being impersonated.

Unattended video recording

Unattended video recording

Depending on the legal framework, the Digital Onboarding process sometimes is video recorded as support in an unattended operation. MobbScan integrates the videoconference, allowing the generation of a video file from camera flow to its later review.

All pieces of evidence generated in Digital Onboarding processes are stored in the client´s databases using robust coding to comply with data protection law.

Implementation in a matter of days - Web Gateway

The integration of MobbScan technology in a web environment is accomplished through a web Gateway. It is a web application that enables digital onboarding processes, significantly streamlining integration processes to the extent that integration time is reduced to 1 or 2 days.

Supported languages can be configured, and in terms of usability, informational dialogs, texts, colors, fonts, images, etc., can be customized.

Technology evaluated by NIST

Our facial recognition technology has undergone evaluation by the NIST for both verification (1:1) and identification (1:N) processes: FRVT 1:1 and FRVT 1:N.

These evaluations demonstrate our capability to accurately identify individuals reinforcing our position as leaders in the field of biometric identification.

KYC/AML/Due Diligence/Sepblac Compliance

To ensure compliance with KYC and AML regulations, MobbScan verifies that a customer is who they say to be during the registration process while assessing if the information provided by the customer is precise.

Furthermore, MobbScan has an extensive and constantly evolving database to check different public lists to comply with Due Diligence checks:

- International Sanctions

- Terrorists

- International PEPs

- Adverse news

In addition, you can use a monitoring system to proactively check if any of your customers have become a risk individual by performing due diligence checks. This check can be done while a relationship with the customer exists.

In Spain, SEPBLAC (Financial Intelligence Unit) is the supervisor for preventing money laundering and terrorist financing and is also responsible for defining due diligence measures. It enables companies to perform identification measures through video identification. Our technology allows recording on video the entire process for subsequent review.

Multiplatform

Multiplatform solution compatible with Android, iOS, Web (Web Gateway), Cordova/Ionic, React Native and Restful APIs.

DISCOVER OUR KYC / AML GUIDES

Digital Onboarding Course (Free)

Understanding the technology before implementing it ensures that you make the most of its potential.

This technology is the first point of contact with your customer and defines the course of your relationship.

KYC (Know Your Customer) guide

An organization’s journey with its customers begins with proper verification, ensuring the security of both parties. This KYC guide will help you understand the importance of knowing your users and complying with legal requirements.

Let´s talk

Start verifying your users in a matter of seconds